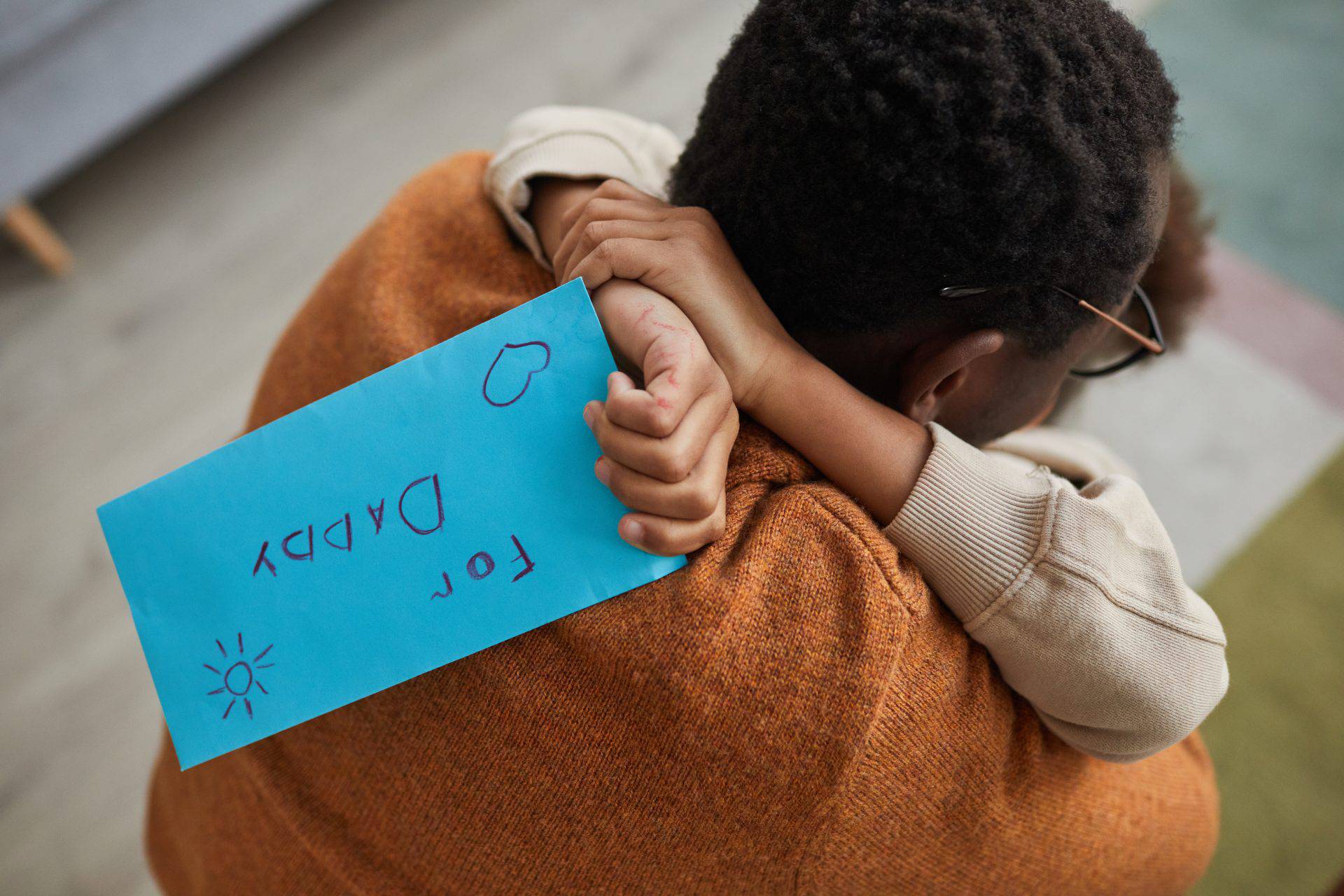

Can California Child Custody Mediation Work for You?

For many parents who disagree on child custody, family law mediation can be a step in the right direction. Mediation is a last-chance effort to establish agreeable terms and avoid litigation.

For many parents who disagree on child custody, family law mediation can be a step in the right direction. Mediation is a last-chance effort to establish agreeable terms and avoid litigation.

In many cases, parties enter into mediation hoping to find common ground regarding child custody, but what they find is that they come out of mediation better communicators. Learning the basic skills of productive communication can be life-changing for some parents.

San Diego Divorce Attorneys Blog

San Diego Divorce Attorneys Blog

One of the important steps in finalizing a divorce is determining how to divide property between the two spouses. In some cases, the division of property can be simple and straightforward. However, it’s possible for complications to arise. It can be helpful to understand the top five ways to protect your assets during a divorce in California to avoid these situations.

One of the important steps in finalizing a divorce is determining how to divide property between the two spouses. In some cases, the division of property can be simple and straightforward. However, it’s possible for complications to arise. It can be helpful to understand the top five ways to protect your assets during a divorce in California to avoid these situations. After you finalize a divorce, the hope is that you won’t have to deal with issues with your ex-spouse any longer. Unfortunately, divorce isn’t always the end for some people. This can be especially true when children are involved. If you were married with minor children, it’s likely that child custody came up as a term of the divorce. If you’re struggling with the terms of your child custody outcome, here are several tips for navigating disputes in California.

After you finalize a divorce, the hope is that you won’t have to deal with issues with your ex-spouse any longer. Unfortunately, divorce isn’t always the end for some people. This can be especially true when children are involved. If you were married with minor children, it’s likely that child custody came up as a term of the divorce. If you’re struggling with the terms of your child custody outcome, here are several tips for navigating disputes in California. You’ve been served divorce papers, and you’re not sure what to do next. Navigating a divorce can be stressful and confusing due to the emotional implications of the process alone. Moreover, every divorce is different, so it can be difficult to know what to expect out of the process. Depending on the unique facets of your marriage, divorce settlements can involve any number of terms and conditions.

You’ve been served divorce papers, and you’re not sure what to do next. Navigating a divorce can be stressful and confusing due to the emotional implications of the process alone. Moreover, every divorce is different, so it can be difficult to know what to expect out of the process. Depending on the unique facets of your marriage, divorce settlements can involve any number of terms and conditions. After you finalize a divorce, you want to believe that it’s the end of overcoming challenges with your ex-spouse. Unfortunately, this isn’t always the case, especially if children are involved. If your ex-spouse is not following the terms of your divorce, contact a California family law attorney. A trusted family lawyer can help you figure out how to proceed with certain situations, such as what to do if your ex-spouse is not paying spousal support in California.

After you finalize a divorce, you want to believe that it’s the end of overcoming challenges with your ex-spouse. Unfortunately, this isn’t always the case, especially if children are involved. If your ex-spouse is not following the terms of your divorce, contact a California family law attorney. A trusted family lawyer can help you figure out how to proceed with certain situations, such as what to do if your ex-spouse is not paying spousal support in California. Separated parents face challenges in co-parenting, but it becomes almost unmanageable when dealing with an especially troublesome ex. Shared custody and decision-making become emotionally exhausting when your ex-partner demonstrates uncooperative behavior and manipulation while creating continuous conflict. We can give you tips about how to co-parent with a difficult ex.

Separated parents face challenges in co-parenting, but it becomes almost unmanageable when dealing with an especially troublesome ex. Shared custody and decision-making become emotionally exhausting when your ex-partner demonstrates uncooperative behavior and manipulation while creating continuous conflict. We can give you tips about how to co-parent with a difficult ex. Blended families experiencing a divorce can face unique challenges when it comes to child custody and support. All the factors normally considered, such as custody arrangements and who pays child support, may not be as straightforward as they seem in standard divorce cases due to the fact that stepparents do not share the same legal responsibilities as biological parents.

Blended families experiencing a divorce can face unique challenges when it comes to child custody and support. All the factors normally considered, such as custody arrangements and who pays child support, may not be as straightforward as they seem in standard divorce cases due to the fact that stepparents do not share the same legal responsibilities as biological parents. You’ve gone through mediation and to court, and there are agreements in place, yet your ex-spouse still isn’t holding up their end of the agreement. When it comes to how to handle child support arrears in California, even though things might seem stressful right now, we can help.

You’ve gone through mediation and to court, and there are agreements in place, yet your ex-spouse still isn’t holding up their end of the agreement. When it comes to how to handle child support arrears in California, even though things might seem stressful right now, we can help. In California, ‘legal separation’ means that a married couple can live independently without fully and formally dissolving their marriage. There are some benefits and disadvantages to obtaining a legal separation. A seasoned attorney who is familiar with legal separation cases can further discuss all options for dissolving a relationship.

In California, ‘legal separation’ means that a married couple can live independently without fully and formally dissolving their marriage. There are some benefits and disadvantages to obtaining a legal separation. A seasoned attorney who is familiar with legal separation cases can further discuss all options for dissolving a relationship. A child custody case in California can be an emotionally challenging, legally complex, and stressful process for everyone involved. Although a criminal conviction doesn’t always disqualify a parent from custody or visitation, it’s an important factor that California courts assess carefully. The court’s main goal is to protect the best interest of the child.

A child custody case in California can be an emotionally challenging, legally complex, and stressful process for everyone involved. Although a criminal conviction doesn’t always disqualify a parent from custody or visitation, it’s an important factor that California courts assess carefully. The court’s main goal is to protect the best interest of the child.